Case Study

Payment Companies

Case Study: Streamlining Payment

Processing with Ospree

Payment processing companies must manage high transaction volumes while ensuring compliance and speed. AB Payments (*), a leading payment processor with a global customer base, grapples with maintaining efficient operations amidst stringent regulatory requirements and high customer expectations for rapid, uninterrupted service. Using multiple tools in isolation adds complexity, so the company sought a comprehensive, flexible, and scalable solution.

Challenge – Disruption from False Positives: AB Payments faced significant disruptions in their operational flow due to the high incidence of false positives in transaction processing. These false flags frequently blocked legitimate transactions, leading to a poorer customer experience and increased manual intervention, which strained resources and extended transaction times.

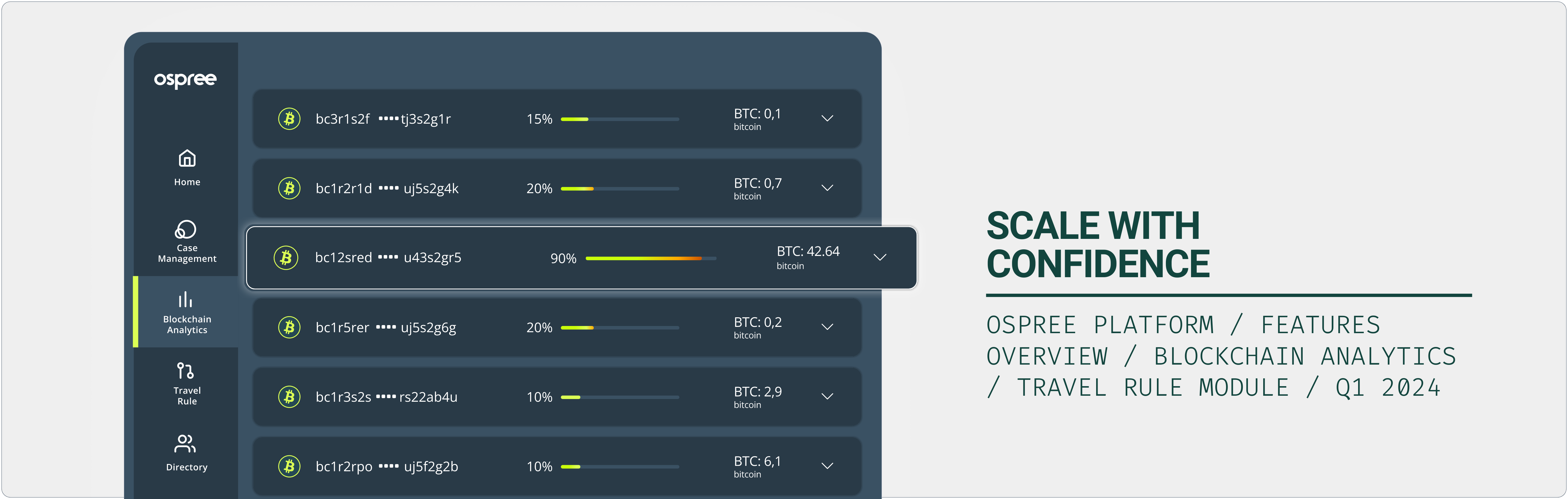

Solution – Automation for Compliance: AB Payments implemented Ospree’s platform to automate Anti-Money Laundering (AML) checks. Using detection scenario rules, the platform identified patterns and anomalies indicative of genuine risk while ensuring the smooth processing of legitimate transactions. As a result, the platform significantly reduced the rate of false positives and the need for manual reviews.

Challenge – High Transaction Volumes: Handling millions of transactions daily, AB Payments struggled to scale its infrastructure during peak periods without compromising performance or reliability. This limitation threatened customer satisfaction and risked regulatory non-compliance at critical times.

Solution – Scalable Infrastructure: To effectively manage escalating transaction volumes, AB Payments integrated Ospree’s REST API, which is specifically designed to scale according to demand without degrading service quality. The API’s robust architecture supports high concurrency and real-time data processing, ensuring that transaction throughput remains high even during peak usage.

Results

AB Payments successfully overcame significant operational hurdles by adopting Ospree’s solution. The company is now better equipped to deliver efficient, compliant, and customer-focused payment processing services. This transformation has led to several key improvements for AB Payments.

▪ Reduced False Positives: Post-implementation, AB Payments significantly decreased the occurrence of false positives, leading to enhanced customer satisfaction and operational efficiency.

▪ Enhanced Scalability: The new system comfortably handled larger transaction volumes during peak periods without an impact on performance.

▪ Operational Efficiency: Automation minimized the need for manual interventions, enabling staff to concentrate on higher-value tasks and strategic initiatives.

▪ Easy Implementation: Similar to a Lego System, the platform seamlessly integrated the Blockchain Analytics and Travel Rule modules with existing infrastructure.