Blockchain Analytics

Unlock deeper insights

Gain the clarity you need to track and analyze transactions. Empower your decisions with comprehensive, data-driven insights.

Blockchain Analytics

Unlock deeper insights

Gain the clarity you need to track and analyze transactions. Empower your decisions with comprehensive, data-driven insights.

Blockchain Analytics

Unlock deeper insights

Gain the clarity you need to track and analyze transactions. Empower your decisions with comprehensive, data-driven insights.

Key Features

EXTRA TOOLS

EXTRA TOOLS

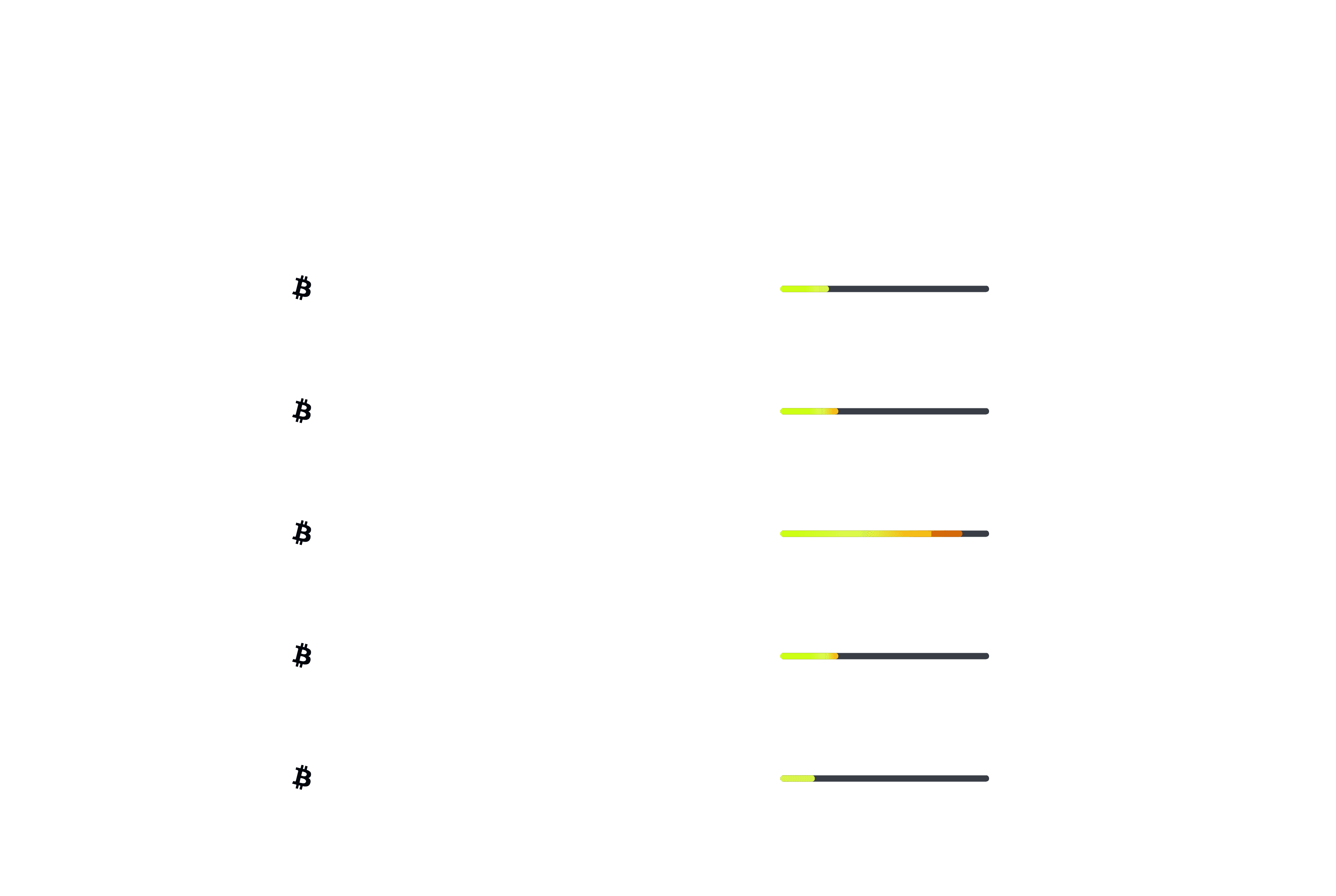

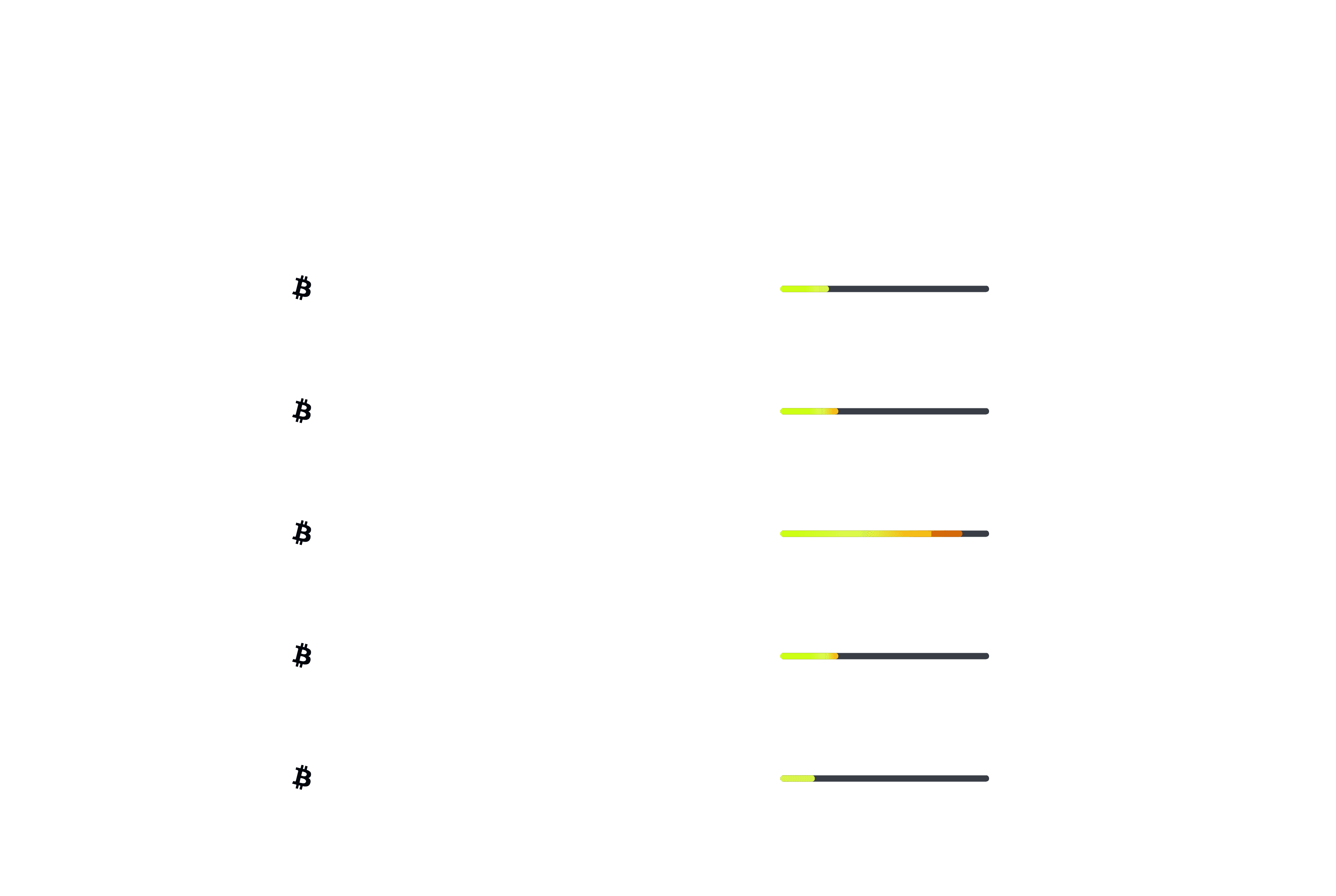

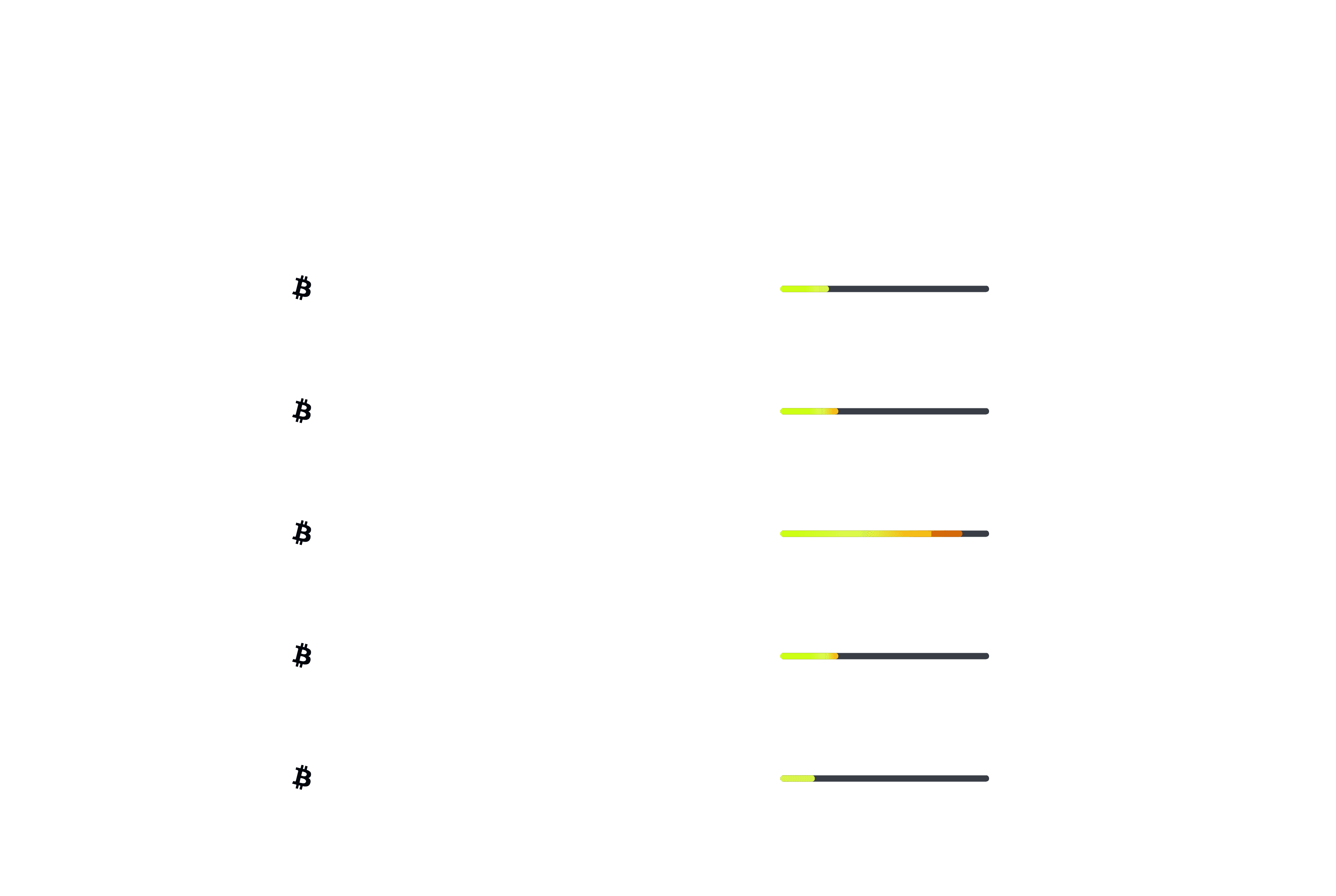

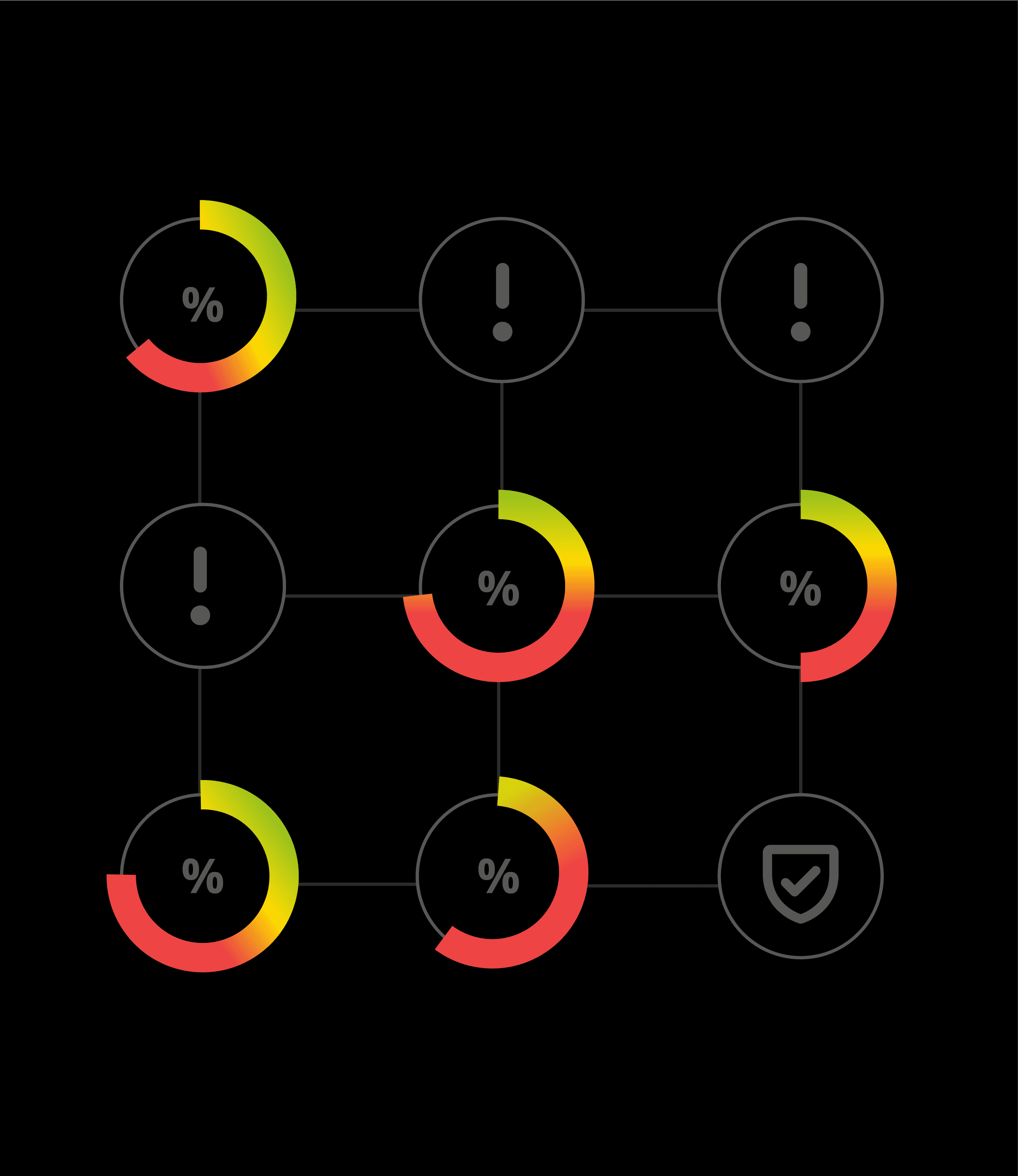

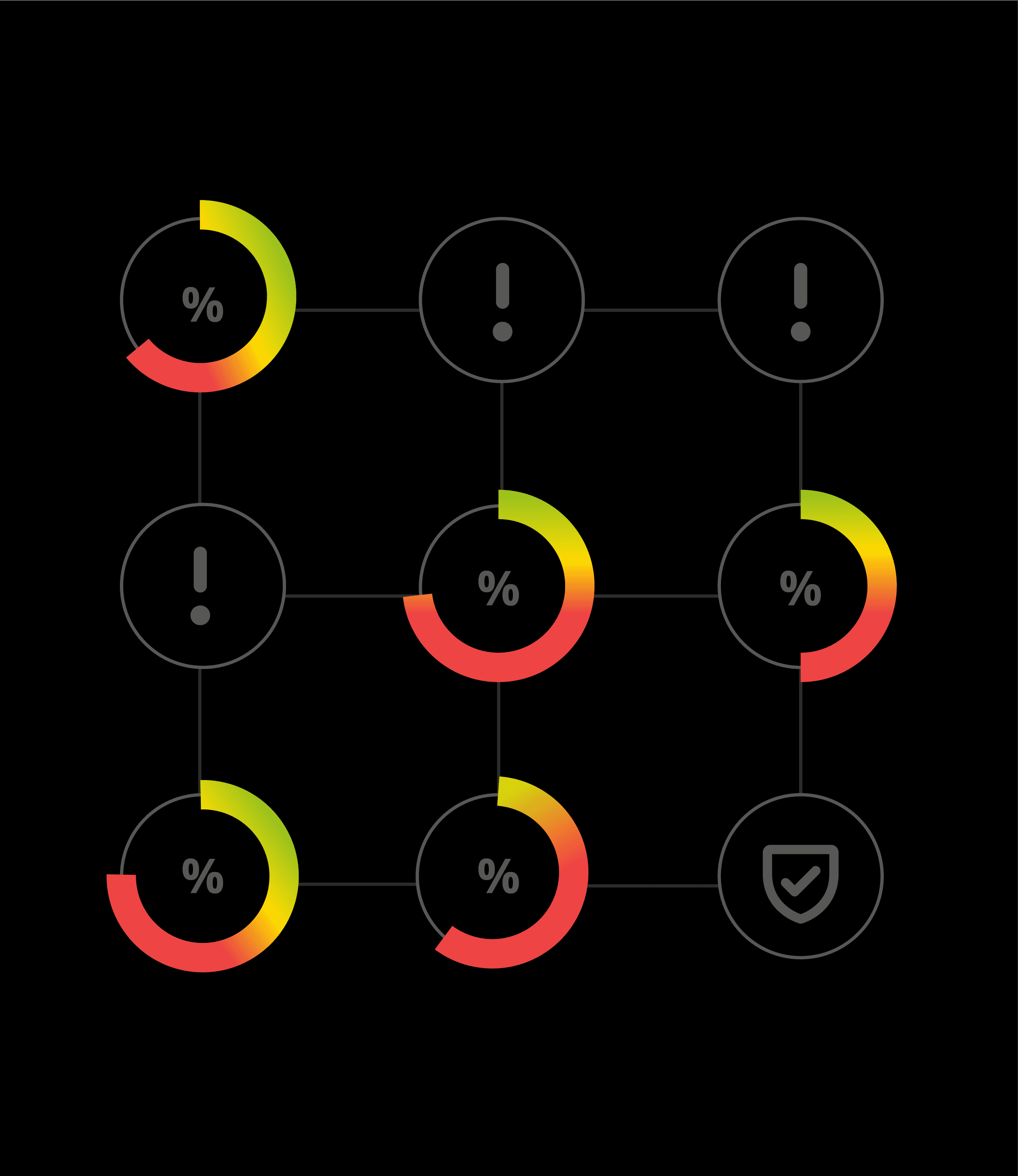

Risk comparison

Risk comparison

Compare risk scores from leading blockchain analytics providers. Easily cross-reference data to verify accuracy, uncover valuable insights.

Compare risk scores from leading blockchain analytics providers. Easily cross-reference data to verify accuracy, uncover valuable insights.

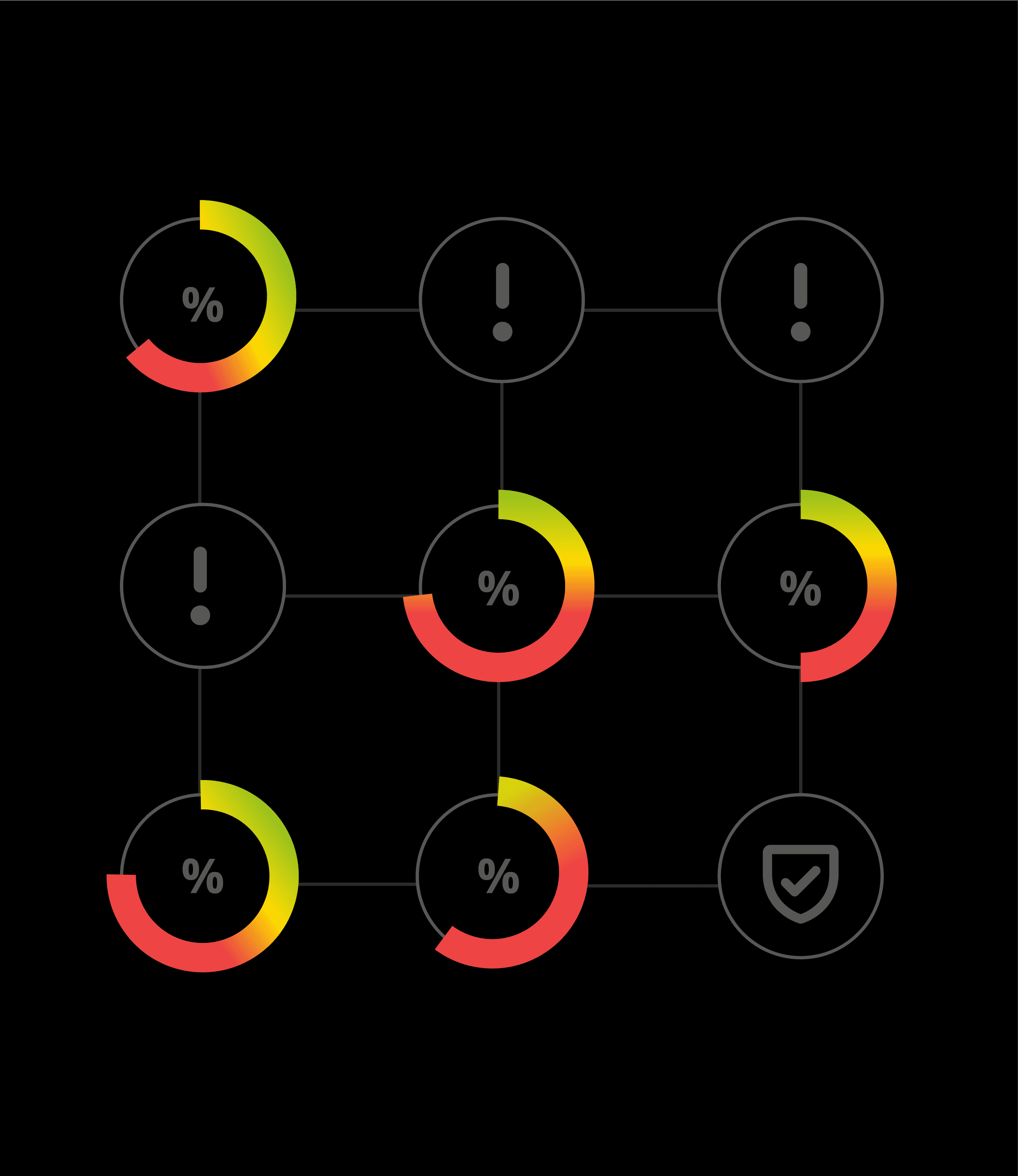

Data agnostic

Data agnostic

Integrate multiple blockchain analytics sources to improve asset coverage and reduce operational risk.

Integrate multiple blockchain analytics sources to improve asset coverage and reduce operational risk.

Explore a wide range of investment options, tailored to your financial goals.

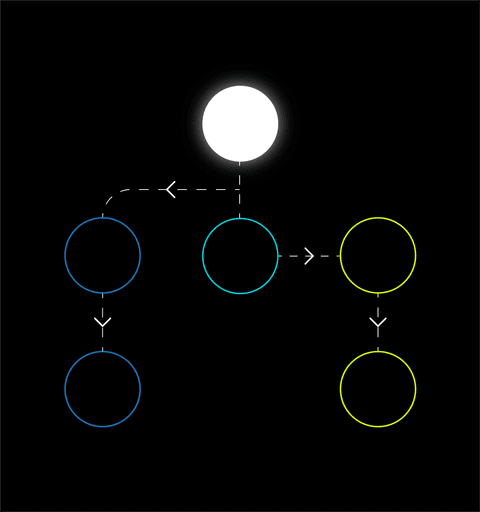

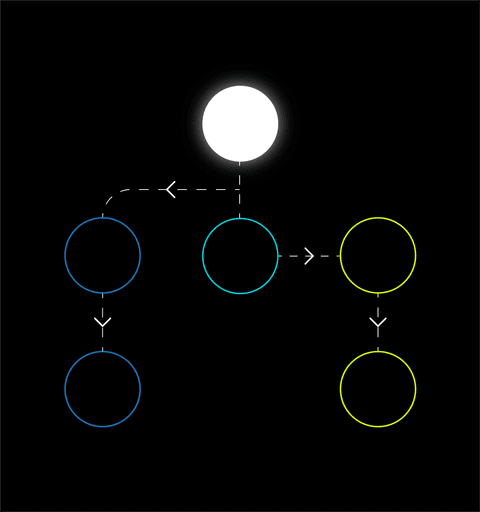

Wallet linking

Wallet linking

Easily link accounts to multiple wallets and gain immediate access to advanced analytics and risk assessments.

Easily link accounts to multiple wallets and gain immediate access to advanced analytics and risk assessments.

WE'VE GOT YOU COVERED

WE'VE GOT YOU COVERED

WE'VE GOT YOU COVERED

Frequently asked questions

What is blockchain analytics, and why is it important?

How does Ospree’s blockchain analytics solution enhance compliance efforts?

Can Ospree’s blockchain analytics integrate with existing systems?

What are the benefits of wallet linking in Ospree’s blockchain analytics?

What is blockchain analytics, and why is it important?

How does Ospree’s blockchain analytics solution enhance compliance efforts?

Can Ospree’s blockchain analytics integrate with existing systems?

What are the benefits of wallet linking in Ospree’s blockchain analytics?

What is blockchain analytics, and why is it important?

How does Ospree’s blockchain analytics solution enhance compliance efforts?

Can Ospree’s blockchain analytics integrate with existing systems?

What are the benefits of wallet linking in Ospree’s blockchain analytics?

Simplify compliance

Drive revenue, reduce compliance costs, and grow with Ospree.

Simplify compliance

Drive revenue, reduce compliance costs, and grow with Ospree.

Simplify compliance

Drive revenue, reduce compliance costs, and grow with Ospree.