What is the Travel Rule?

Overview

The FATF’s Travel Rule requires VASPs to securely collect, and exchange essential information about the originator and beneficiary of crypto transfers.

Application Scope

This requirement applies to VA transfers, whether domestic or cross-border, ensuring that VASPs maintain consistent practices for every transaction.

Purpose of the Regulation

The regulation aims to enhance transparency and combat financial crime within virtual asset transactions, supporting global AML efforts.

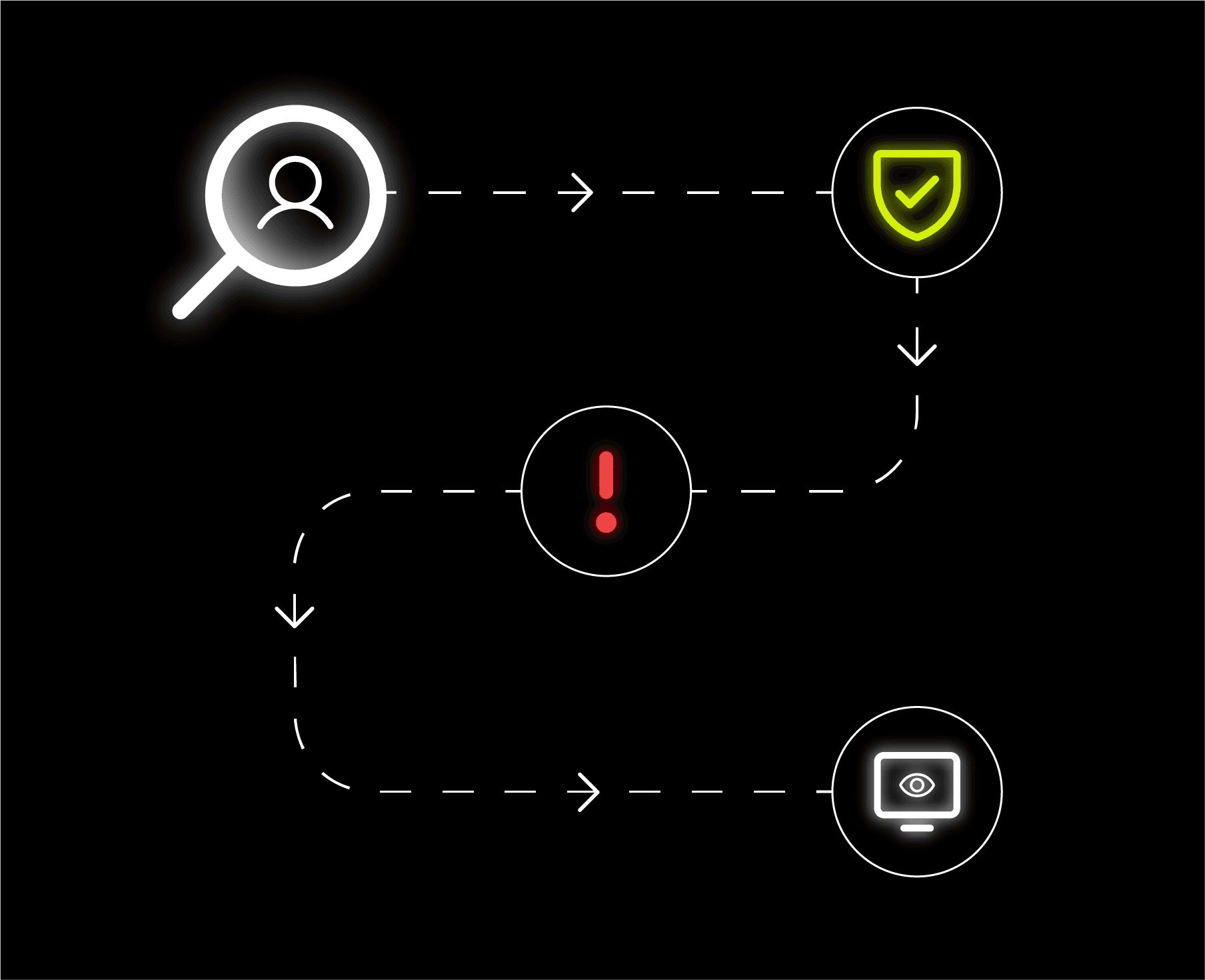

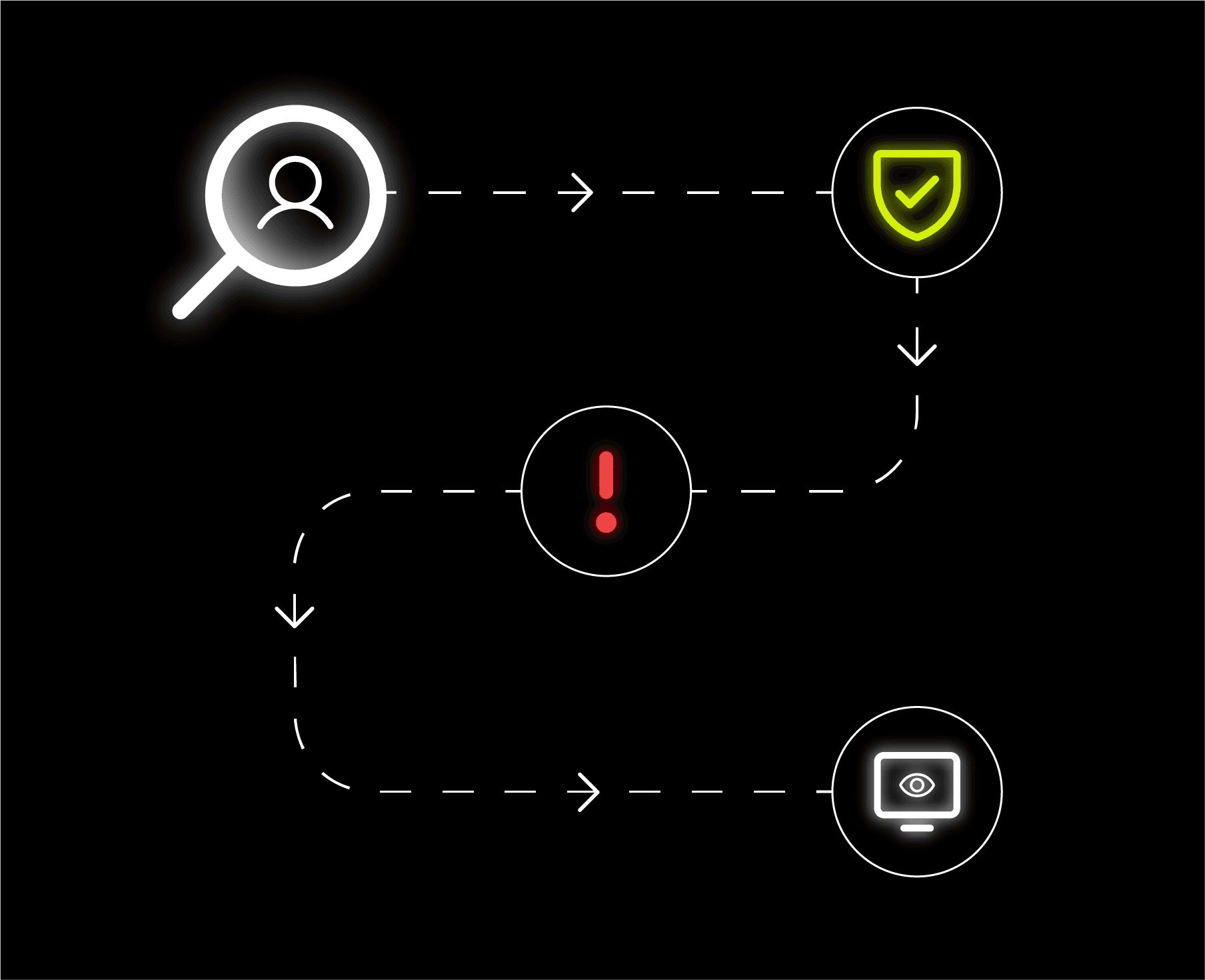

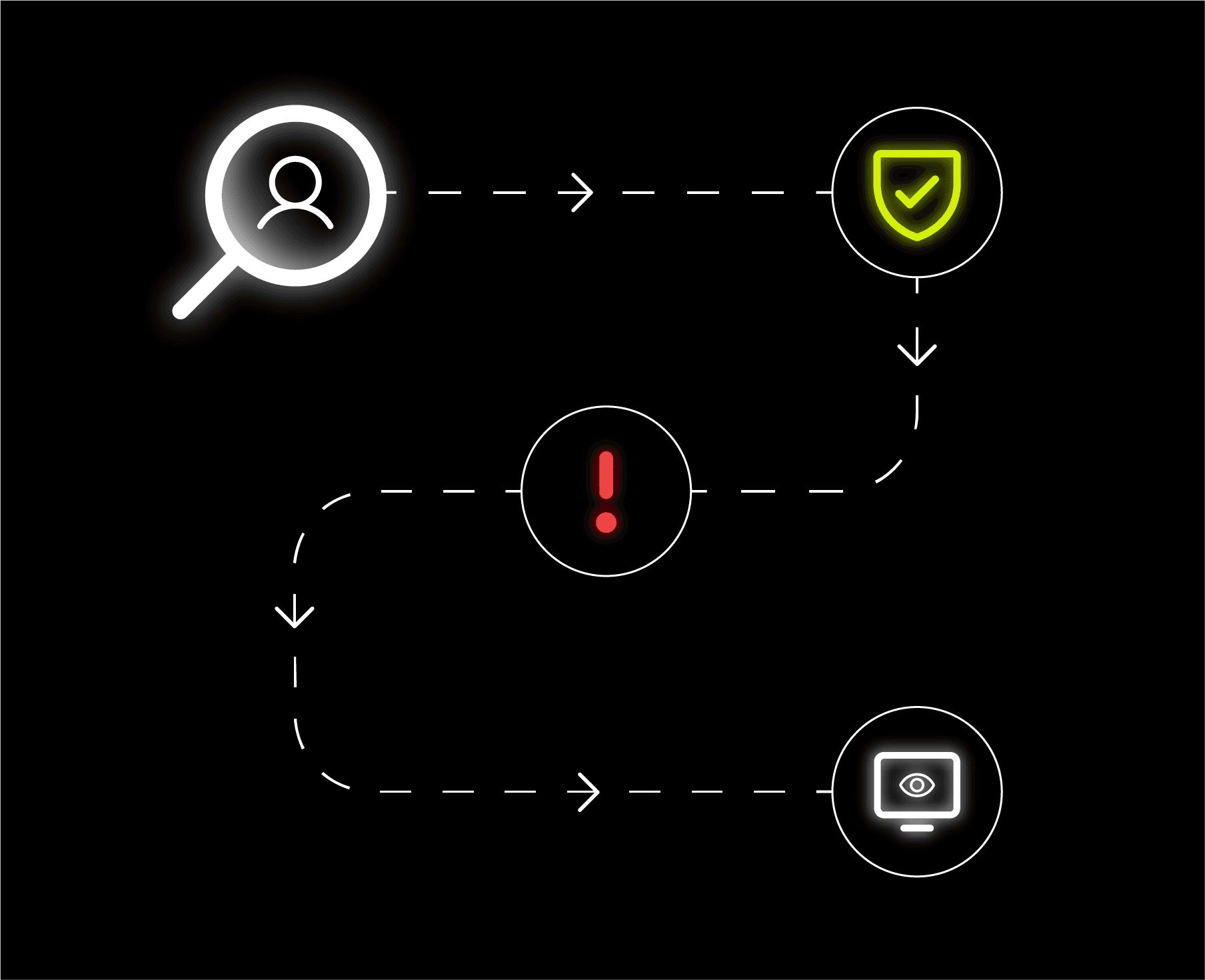

Gain visibility into who you are transacting with

Gain visibility into who you are transacting with

Limited visibility and risky dealings with suspicious entities transform into informed risk assessments and interactions exclusively with verified entities.

VASPs can now conduct thorough risk assessments, ensuring safe transactions with counterparties.

Key Features

VASP

Due Diligence

VASP

Due Diligence

Establish secure, compliant relationships with counterpart Virtual Asset Service Providers (VASPs) through enhanced due diligence tailored to crypto-specific risks.

Establish secure, compliant relationships with counterpart Virtual Asset Service Providers (VASPs) through enhanced due diligence tailored to crypto-specific risks.

Data pre-validation

Data pre-validation

Reduce errors, discrepancies, and formatting issues. Cutting compliance costs and improve customer experience.

Reduce errors, discrepancies, and formatting issues. Cutting compliance costs and improve customer experience.

Sanction screening

Sanction screening

Screen wallets in real-time or pre-transaction using blockchain analytics to identify links to sanctioned entities, reducing risk.

Explore a wide range of investment options, tailored to your financial goals.

Screen wallets in real-time or pre-transaction using blockchain analytics to identify links to sanctioned entities, reducing risk.

Interoperability

EXTENSIVE INTEGRATION

EXTENSIVE INTEGRATION

Effortless interoperability

Ospree enables seamless communication between different Travel Rule protocols, standardizing information to ensure smoother global adoption.

Sunrise issue

Switch the sunlight on

Ensure cross-border compliance with our

robust backup messaging system.

Data Transfer

Ensure seamless compliance when the counterparty VASP lacks similar obligations in its jurisdiction.

Risk Control

Proactively manage and mitigate risks in less regulated areas where data sources are limited.

Sanction screening

Screen data effectively when the counterparty VASP cannot be verified.

Sunrise issue

Switch the sunlight on

Ensure cross-border compliance with our

robust backup messaging system.

Data Transfer

Ensure seamless compliance when the counterparty VASP lacks similar obligations in its jurisdiction.

Risk Control

Proactively manage and mitigate risks in less regulated areas where data sources are limited.

Sanction screening

Screen data effectively when the counterparty VASP cannot be verified.

Sunrise issue

Switch the sunlight on

Ensure cross-border compliance with our

robust backup messaging system.

Data Transfer

Ensure compliance when the counterparty VASP lacks similar obligations.

Risk management

Manage risks in less regulated areas when crucial information is unavailable.

Sanction screening

Screen effectively when the counterparty VASP cannot be verified.

Sunrise issue

Switch the sunlight on

Ensure cross-border compliance with our

robust backup messaging system.

Data Transfer

Ensure compliance when the counterparty VASP lacks similar obligations.

Risk management

Manage risks in less regulated areas when crucial information is unavailable.

Sanction screening

Screen effectively when the counterparty VASP cannot be verified.

WE'VE GOT YOU COVERED

Frequently asked questions

What is the Travel Rule, and why is it important for crypto transactions?

How does Ospree’s Travel Rule solution support global compliance?

What benefits does integrating Travel Rule compliance with blockchain analytics bring?

What steps does Ospree take to support compliance with the Travel Rule as regulations evolve?

What is the Travel Rule, and why is it important for crypto transactions?

How does Ospree’s Travel Rule solution support global compliance?

What benefits does integrating Travel Rule compliance with blockchain analytics bring?

What steps does Ospree take to support compliance with the Travel Rule as regulations evolve?

What is the Travel Rule, and why is it important for crypto transactions?

How does Ospree’s Travel Rule solution support global compliance?

What benefits does integrating Travel Rule compliance with blockchain analytics bring?

What steps does Ospree take to support compliance with the Travel Rule as regulations evolve?

Simplify compliance

Drive revenue, reduce compliance costs, and grow with Ospree.

Simplify compliance

Drive revenue, reduce compliance costs, and grow with Ospree.

Simplify compliance

Drive revenue, reduce compliance costs, and grow with Ospree.